An education tax credit happens to be a form of tax reprieve for students or their parents for the purpose of defraying the costs of getting higher education. Generally speaking, there are two main types of education tax credit that may be claimed in the US. These are the American opportunity tax credit (AOTC) and the lifetime learning credit (LLC). The tax legislation changes constantly so filing your taxes with the help of an expert might be the best course of action, making sure you take advantage of every tax credit available to you.

Typically, qualified education expenses for both AOTC and LLC cover the cost for tuition and mandatory charges for either enrollment or attendance at an eligible tertiary education institution. Living expenses, on the other hand, including room and board, medical care, and transportation don’t qualify for an education tax credit in the United States.

The American opportunity tax credit

This education credit is primarily designed for undergraduate students or their parents if they are listed as dependents in the latter’s tax returns. Eligible applicants may claim no more than $2,500 on higher education expenses incurred during any given tax year.

The American opportunity tax credit can be claimed for up to a maximum of 4 years (generally the usual timespan to obtain an undergraduate degree). To be in a good position of claiming the full AOTC credit, your modified adjusted gross income (MAGI) for the preceding year must be no more than $80,000. Should your MAGI have been more than $80,000, but less than $90,000, you will be eligible for a reduced credit.

Another mandatory requirement for accessing the American opportunity tax credit as a student is not having completed the first 4 years of tertiary education. They also shouldn’t have claimed it for over 4 years, and lastly, they haven’t been convicted for either a federal or state felony drug offense.

Lifetime learning credit

This sort of education tax credit is open for taxpayers who’ve taken at least one course at an eligible education institute (one which participates in the federal student aid program). Like AOTC, the lifetime learning credit doesn’t cover the living expenses of an eligible student incurred during the year claimed.

Unlike AOTC, there isn’t any limit on the number of years for claiming this education tax credit during any given tax year. This definitely means lifetime learning credit is open not only for undergraduate students but graduate and vocational students as well. Eligible applicants may claim a maximum of $2,000 if their modified adjusted gross income must be no more than $59,000. On the flipside, should your MAGI be less than $69,000, you may claim a reduced credit.

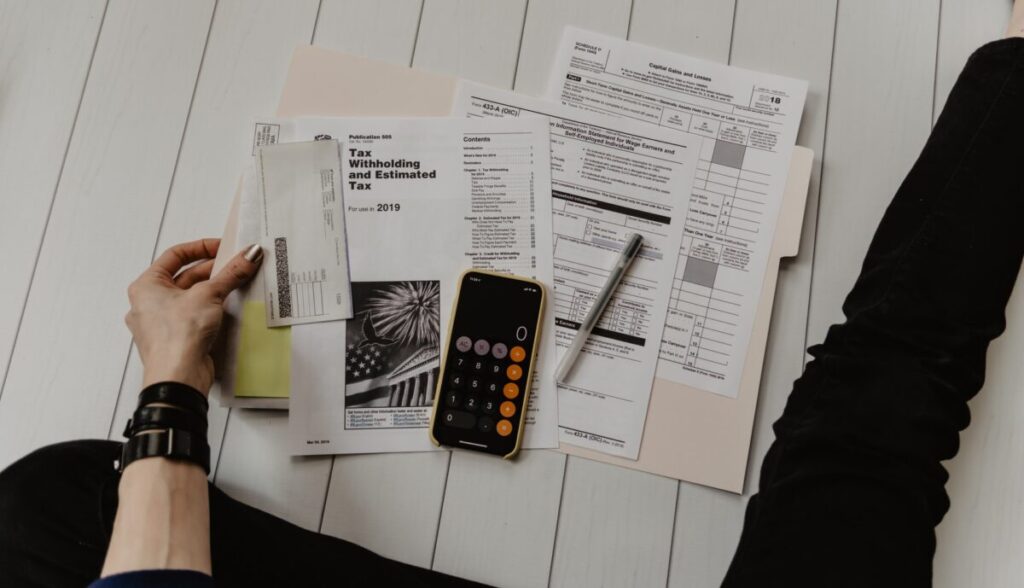

What forms do you need to fill to claim education tax credit?

To be able to claim an education tax credit, you will have to fill out Form 1098-T and file it with your tax return for the preceding year. Form 1098-T is essentially a tuition statement that tabulates the education expenses you incurred over the course of any tax year. It is usually issued by an eligible educational institution to all students who may wish to claim tax credits. At this juncture, it is important to note that the IRS holds you legally accountable for the accuracy of the figures on your tax return including those for your education tax credit claim. So, it is always prudent if you decide to use the services of a professional tax preparer, to verify their competency beforehand.

Veronica Rhodes from TFX

TFX is a women-owned tax firm that offers all U.S. tax services — for both American citizens and non-citizens with U.S. tax filing requirements. From straightforward expat tax preparation to complex cases involving multiple factors — we’ve handled it all for over 25 years.