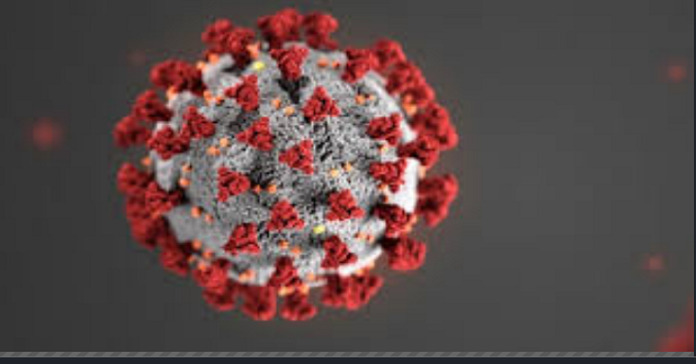

A business budget is crucial as it allows complete control of your organization’s finance. It ensures that you don’t overspend and keep track of every financial objective. Since the world is under the grip of COVID-19, the business budget may get disturbed. But like every business owner, you also want your finances and business budget on track post-COVID-19. For that, it is necessary to follow crucial guidelines.

What does Jared Jeffrey Davis Sandusky, Ohio, say about budget management post-pandemic?

Companies all across the country had halted operations and witnessed a decrease in cash flow. That was a natural fall out because of the pandemic. Currently, as the states are lifting the stay-at-home orders and allowing people to work from an office as long as parameters and protocols are followed, businesses are required to adjust to the new standard rules and budget management tactics. Jared Jeffrey Davis Sandusky, Ohio, business owner suggests the following steps:

The new numbers

Today, businesses have been affected because of lockdowns and physical distancing regulations. It could be that you had to close your business for a while. Alternatively, you might have made the best use of the situation at hand in order to create substantial revenue. In both cases, your earnings did undergo a few changes in the past few months. There will be a change in cash flow before and after COVID-19, for which you may need to rework the business budget. If you find a reduction in earning because of the pandemic, you should account for the same in the budget. Do you want to resolve the negative cash flow? If yes, it is necessary to make cost cuts as well as eliminate any unnecessary expenditure.

Emergency fund

Do you have a cash reserve and emergency fund for your business? According to a recent study, approximately 60% of companies have savings in the bank for emergency costs. Even though the business emergency funds may not have a chance to be used, it’s essential for your business to have one even when there are no emergencies. No one knows the kind of urgency that can occur in your business niche. No business owner could have predicted that COVID-19 would have been a factor today. Therefore, consider being prepared for a crisis at all times.

Financial forecasting

It would be helpful if you could correctly predict your business’s future. However, that is not possible. However, business owners can choose to be updated with forecasting concerning cash flow and budgets. Are you new to financial forecasting? If so, you need to know that financial forecasting can help you calculate your business’s future financial condition by analyzing past financial reports and information. The economic forecast can help you calculate business costs and earning. It can also develop projections for profit and loss statements, cash flow, and balance sheets.

The process of financial forecasting can help your business get back on the right track. It can also help with budgeting and making changes in the budget plan to survive through the COVID-19 situation. However, you can stay prepared for emergencies that might come up unexpectedlywhile keeping the company’s best interest in mind.